DELIVERING ON STASH’S MISSION

The team at Stash is obsessed with their customers and works to build a life-changing, wealth-building product to serve them. However, as a financial institution, Stash must guarantee security by keeping fraudsters and bad actors off the platform. This is where design thinking came in—getting creative about how to craft solutions that delight the Stash customer, comply with federal regulations, and prevent fraud on the platform.

The U.S. stock market is the largest generator of wealth in our history, and yet 45% of Americans are not currently invested. Stash is on a mission to change that.

As of August 2023

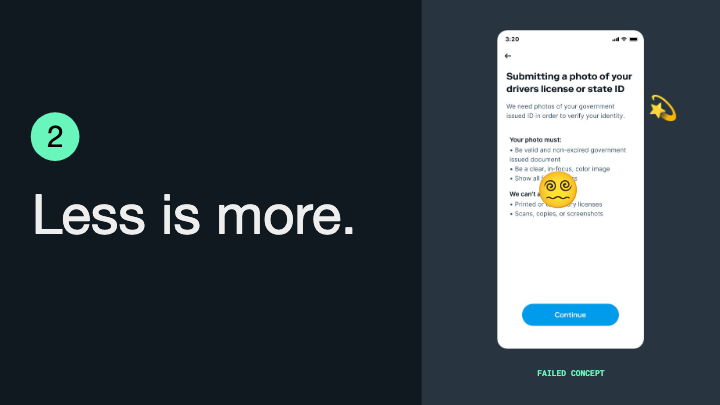

preventing fraud & maintaining a positive experience

Customer trust is absolutely paramount to a growing business, especially so for a business that customers are trusting with their money. This concept of customer trust is really put into practice in the security and fraud prevention space of the business.

Motion conveys a brand’s attitude

While a customer may not be delighted at the request to upload an ID to verify their identity, it’s important that we make the experience a delightful one. The customer should feel celebrated at every turn, and this flow is no exception. The way visuals are animated adds an extra layer to who a brand is, and when animation is carried through the whole experience, it builds a stronger, more meaningful product.

The verification step is a crucial moment. It’s important that we communicate here that Stash’s systems are working properly and that we are doing this for the security of the customer. Here, we are using motion to enforce the idea of trust and security—don’t worry, we’ve got your info locked down safe.

80% of the information our brain processes is visual.

By learning from common mistakes customers make, we created visual directions that take the cognitive load off the customer’s hands.

Here is what this flow looks like today 👇

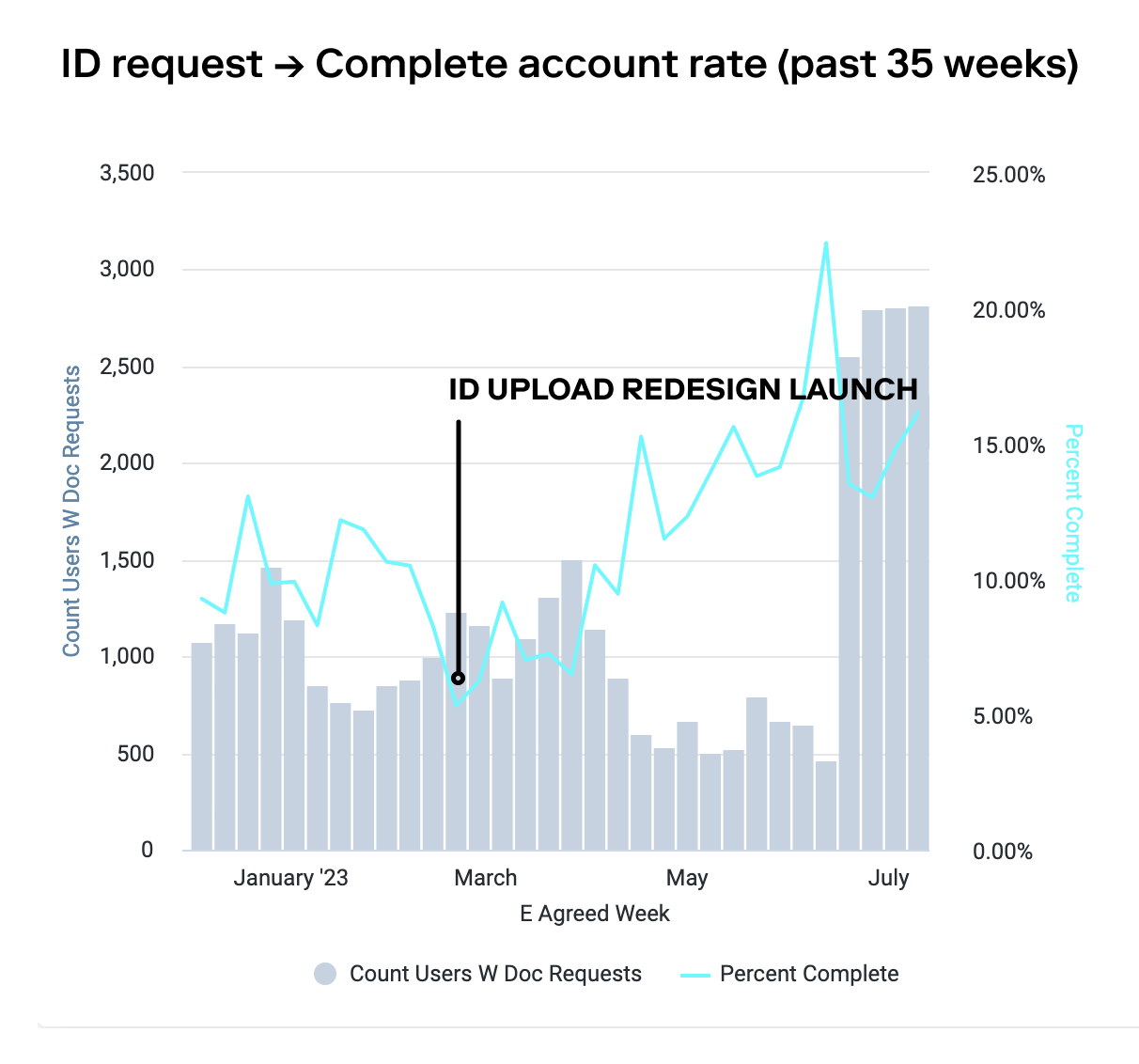

RESULTS WE LOVE TO SEE 🚀

As the numbers illustrate, thoughtful design delivered meaningful impact to Stash’s bottom line. Today, 20% more customers successfully open investment accounts who would have otherwise languished in Identity-Verification-Limbo. Thanks to the clearer flow, instructions, and security reassurances, 14% more customers who experience ID requests are fulfilling those requests. Win, win win!